Central Clearing: Why Merchants Always Save

Everything about central clearing:

- Central clearing from Nexi bundles a day's EC transactions into a single transfer to you.

- You save the high booking fees charged by your bank.

- Instead of the bank, we as the payment service provider execute the individual transactions more cheaply.

- Central clearing is just as secure and just as fast as direct clearing via your bank.

- Nexi offers merchants central clearing in the form of KontoPlus Klassik at a particularly favorable price.

1. Clearing – Settlement for EC card payments

Payment transactions cost money. And the higher the proportion of cashless payments in your retail business, the more you are probably asking yourself where you can save money. We have a suggestion: in clearing.

The Normal Case: Direct Clearing

Clearing refers to the processing of transactions between a buyer and a seller. Banks and payment service providers ensure that the money is transferred securely and efficiently from one account to another:

1. After the customer has paid with the card, the payment terminal memorizes the payment item. When the store closes, the so-called checkout cut-off takes place: the terminal transfers all transactions to the payment service provider, for example to us.

2. We now create the payment transaction files and submit them to your bank.

3. The bank executes the payments, i.e. it collects the money from your customers and transfers it to your business account. Your bank charges you a fee for each payment transaction: the booking item.

Fees come into play in step 3. A merchant normally has to pay around 8 to 10 cents per transaction. For many and especially for small receipt amounts, this is quite significant. The way to save on fees is central clearing. It optimizes this process and reduces costs.

What is "Central Clearing"?

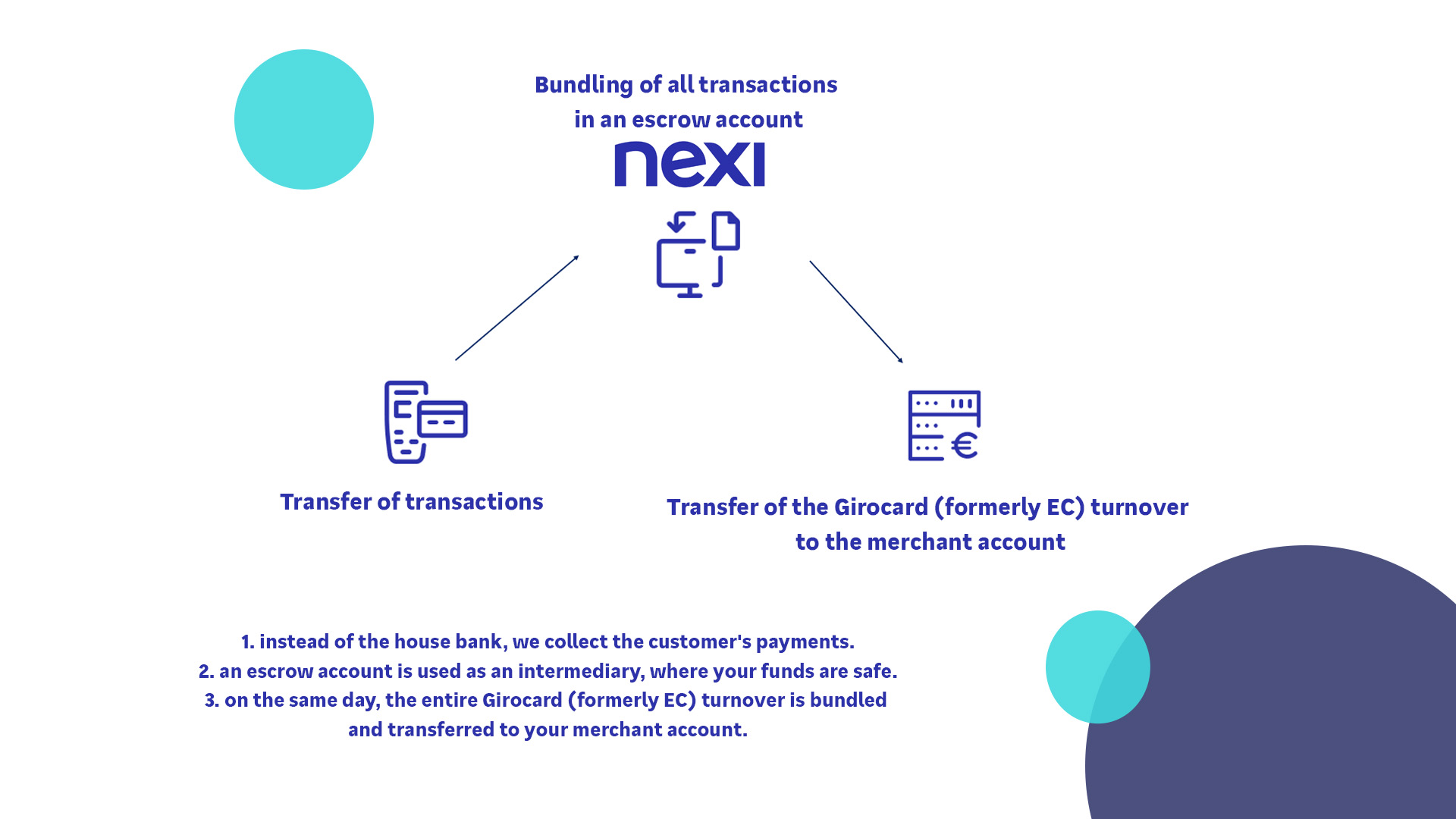

With central clearing, we as a payment service provider offer you as a merchant to settle all girocard or EC card payments of a day bundled via an interim account. The corresponding product is called Account Plus Classic. Only SEPA direct debit transactions are excluded from this.

The interim account is a trust account where the funds are kept safe. You do not have to worry about the funds being lost or misused, as an escrow account is always regulated and protected by BaFin as a so-called payment service. As soon as all transactions are completed, the money is transferred to your business account in one lump sum. This means:

1. Instead of the house bank, we collect the customer's payments.

2. An escrow account is used as a stopover where your funds are safe.

3. On the same day, the entire EC turnover is bundled and transferred to your merchant account.

Cost structure for central clearing

Only a single item fee is due to the house bank for central clearing, namely for the collective transfer. Instead, you pay fees to us, but these are much cheaper.

2. Why is Central Clearing Always Cheaper?

Quantities also determine the price structure in payment transactions. This means that smaller merchants with few transactions generally pay more per transaction than large merchants with many transactions. By taking over and bundling the bookings for our customers, we can pass on lower transaction fees due to the sheer volume. This is the reason why central clearing always pays off and always saves money.

3. Calculation Example: Boutique with 100 EC Bookings per day

Let's imagine a boutique with 100 card payments a day, with each payment averaging 50 euros. Without central clearing, each transaction incurs around 10 cents in bank charges. With 100 transactions, that would be 10 euros per day, or around 260 euros per month.

With central clearing, these fees are eliminated. The payment service provider charges a much smaller fee per transaction, in our calculation example it is 4 cents. With 100 transactions plus one collective transaction, that would only be around 4 euros in fees per day and just over 100 euros per month. The savings amount to almost 2,000 euros per year!

4. For which Merchants is Central Clearing suitable?

Central clearing with our Account Plus Classic is particularly interesting for retailers who process a large number of card payments every day, such as everyday stores, bakeries, boutiques or bookshops. Restaurants and cafés also benefit from central clearing.

Here, the large number of individual transactions results in considerable bank charges, which can be massively reduced by central clearing.

5. Advantages and Disadvantages: Central Clearing at a glance

The Advantages of Central Clearing

The most important advantage: saving costs. The accounting department is also happy. This is because pre-processing by the payment service provider ensures that only the total of all payments made on the EC device has to be reconciled with the total of the collective credit note. Incidentally, the value date on the account is the same as with direct clearing.

The Disadvantages of Central Clearing

One objection sometimes raised against central clearing is that the name of the clearing provider may appear on the customer's bank statement. Critics say that this could lead to confusion. Whether this is the case depends on how the respective bank interprets the so-called tax code. However, the name of the merchant always appears in the purpose of use at the latest. Traceability and transparency are therefore guaranteed in any case.

Conclusion

If you don't want to throw your money down the drain, there's no getting around central clearing for Girocard payments. Without additional investment or opening an account, you benefit from a simpler and cheaper procedure. You receive all Girocard transactions of a day bundled together in your account on the same value date. And depending on the transaction structure, you pay up to 50 percent less in booking fees.

Do the math for you?

Our offer for your central clearing is called Account Plus Classic. This allows you to bundle all Girocard / EC transactions. Do you already operate a Nexi payment terminal? Then no further investment is necessary. We will be happy to calculate everything for you. Even if you are not yet with Nexi.