5 Payment Trends You Should Keep An Eye on for 2024

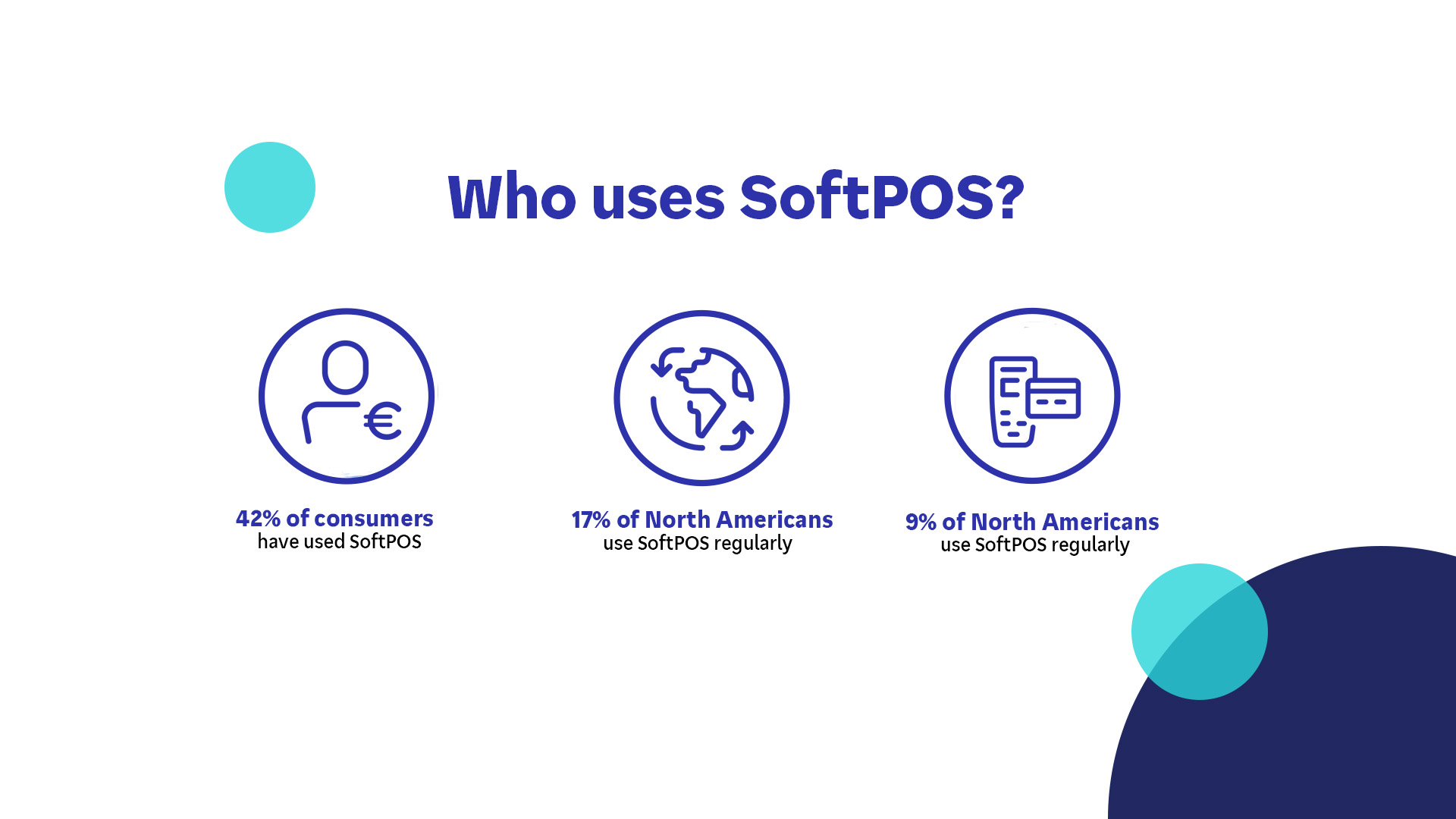

1. Consumers test and approve of SoftPOS (Software Point of Sale)

SoftPOS allows merchants to use a commercially available device (e.g. a cell phone) to accept contactless payments without hardware such as a payment terminal or dongle. Merchants benefit from SoftPOS because they do not need to invest in traditional payment terminals, while customers benefit from the familiarity of using tap-to-pay or digital wallets to make transactions with a mobile device. The number of SoftPOS users will grow by approximately 475% by 2027 ¹, making SoftPOS an important factor in the payment system.

¹ The difference in usage between North America and Europe may be due to the availability of SoftPOS providers. Base: All respondents (n=700). Source: Survey commissioned by Discover Global Network, 2024.

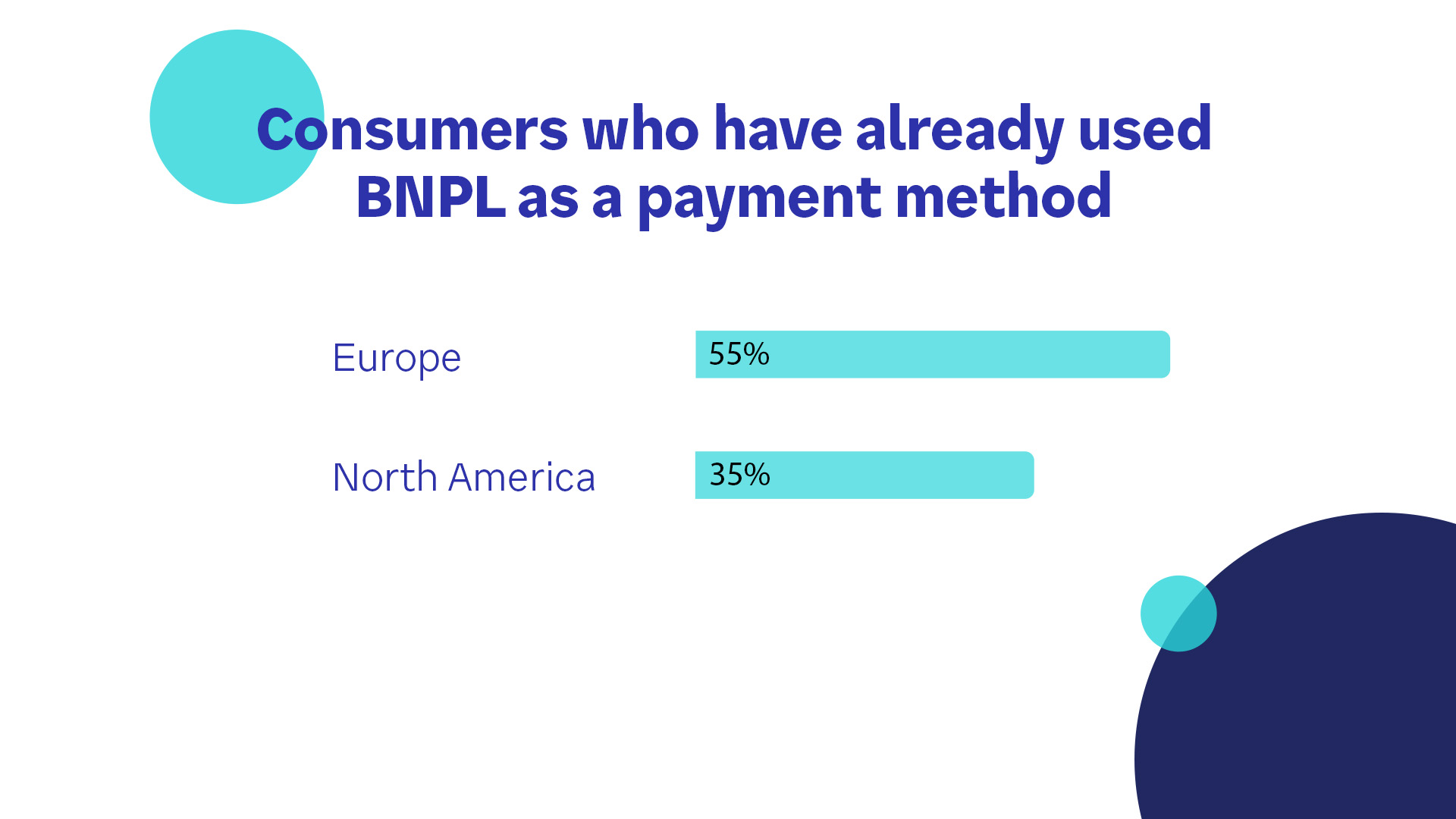

BNPL solutions, which offer shoppers interest-free finance plans for their purchases, have grown in popularity over the past five years. Discover Global Network's survey shows that one in three consumers have used a BNPL plan in the past year, and 73% of consumers who have tried a BNPL plan intend to use it again. ² Although the popularity of BNPL is fluctuating globally, BNPL payments are expected to grow to a quarter of global e-commerce transactions by 2026. ³

F: How often have you used BNPL? Basis: All respondents (n=700). Source: Survey commissioned by Discover Global Network, 2024.

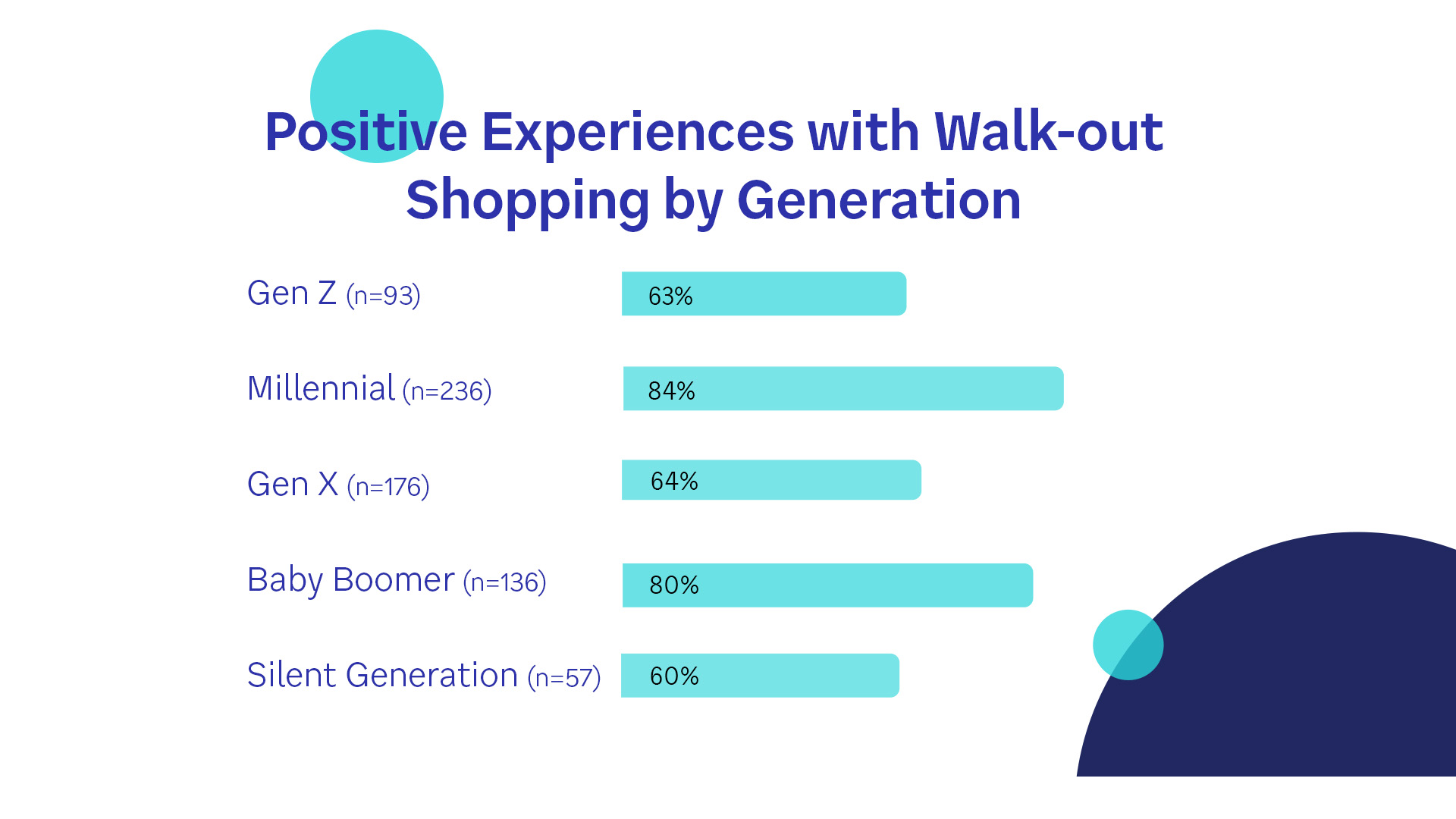

Walk-out shopping technology eliminates typical retail problems by allowing customers to select their own items and leave the store without having to stop at a self-checkout kiosk or cash registers. Amazon first made this technology available in the United States in 2018, and it is now being rolled out in the UK and Australia. Today, more than 85 third-party retailers offer walk-in shopping at sports stadiums, travel agencies, entertainment venues, theme parks, grocery stores, university campuses and hospital cafés. ⁴ Generation Z and 'millennials' have the most experience with it. ²

F: How would you describe your walkout shopping experience? Basis: All respondents (n=700). Source: Survey commissioned by Discover Global Network, 2024.

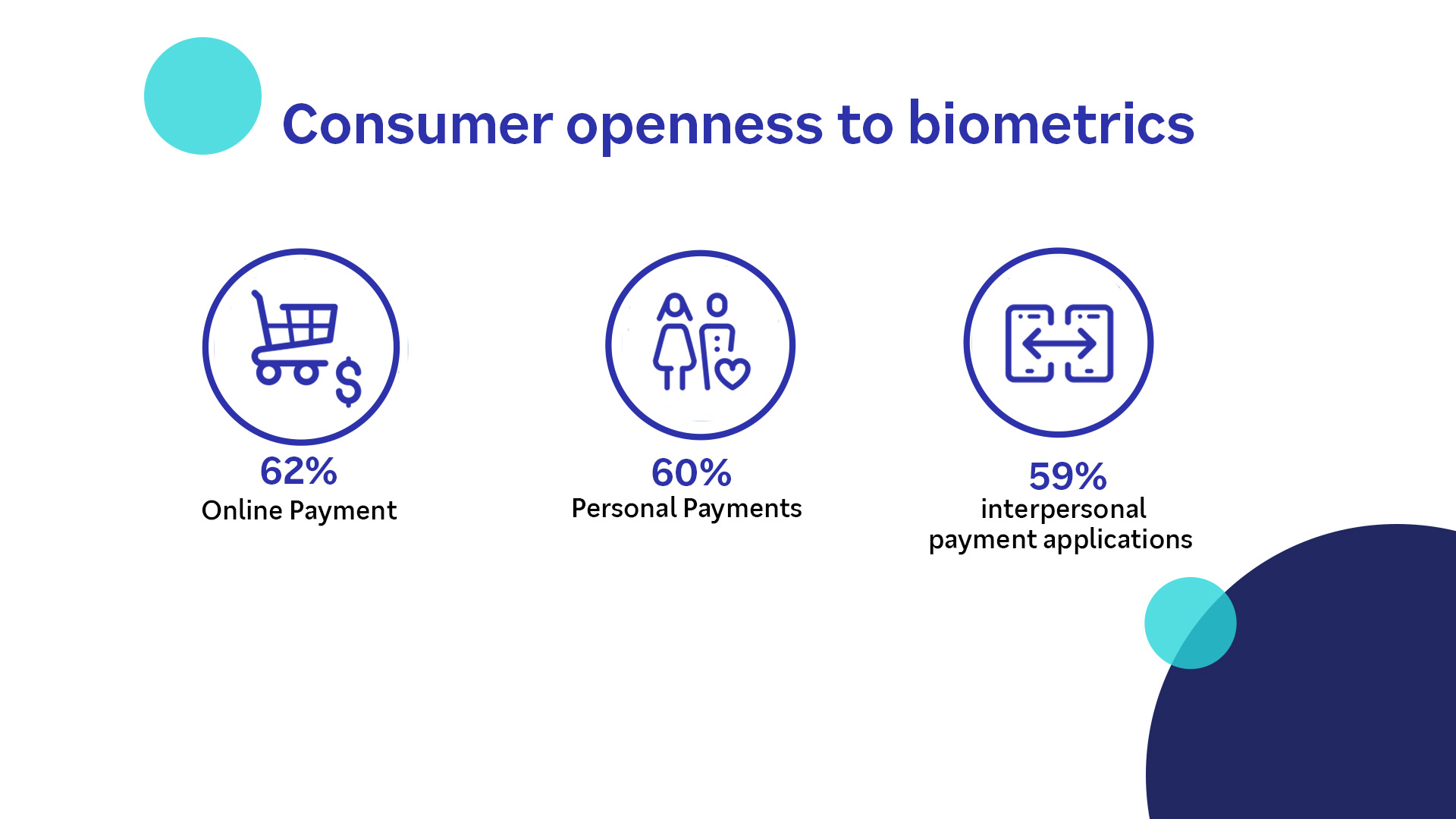

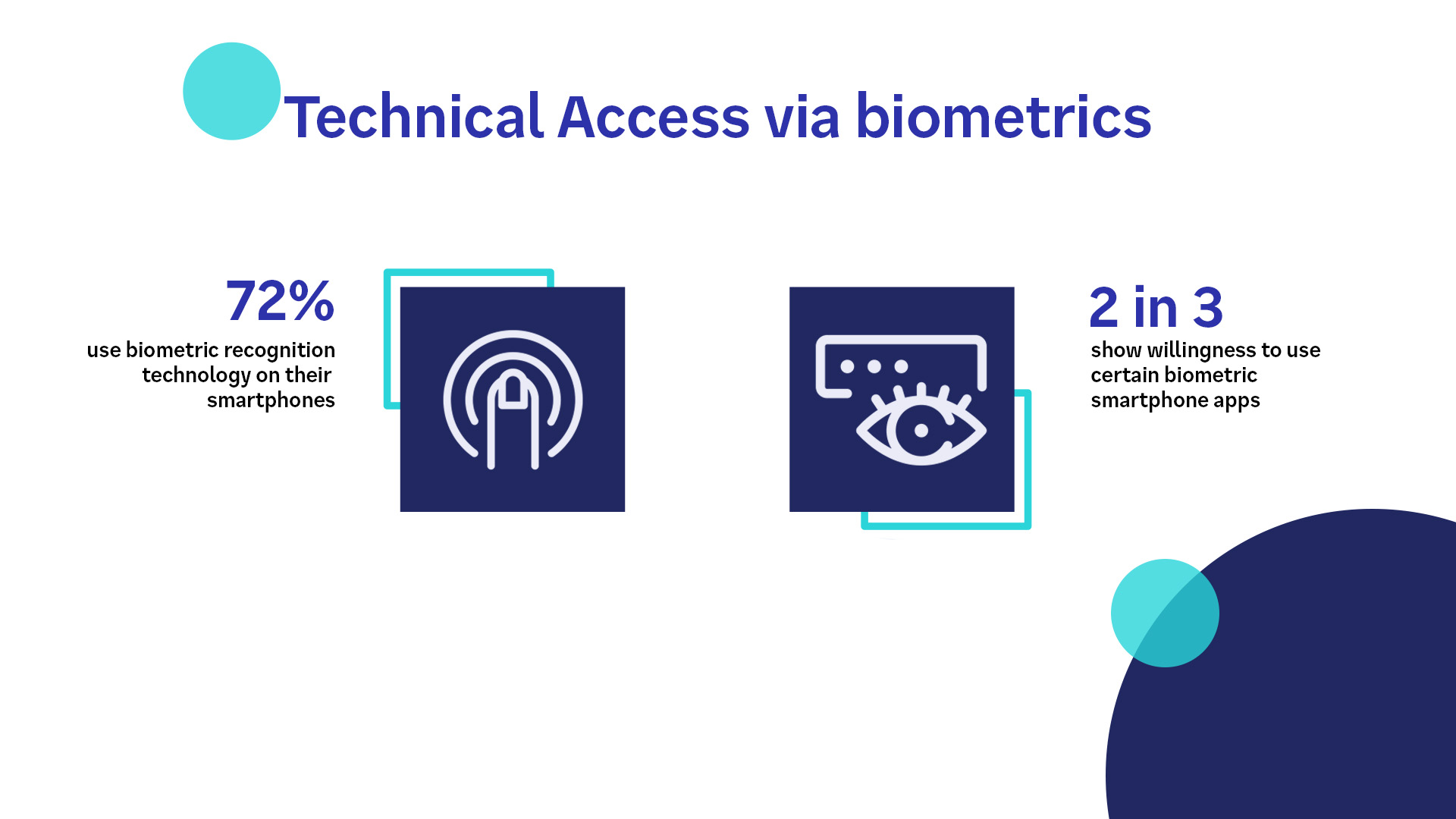

4. Consumers are starting to use Biometric Payments

Biometric payment technology, which allows consumers to confirm their identity through unique characteristics such as fingerprints, facial patterns, iris or voice, without passwords or passcodes, is gaining traction. In 2023, Amazon introduced biometric payments in Whole Foods stores. ⁵ Our research found that not all consumers are ready for it. Attitudes varied by generation, with Generation Z and Millennial shoppers more open to using biometrics for payments than older generations.

F: How open are you to the use of biometric data (e.g. facial recognition) for the following purposes Basis: All respondents (n=700). Source: Survey conducted on behalf of Discover Global Network, 2024.Disclaimer: Percentage of respondents who are at least somewhat open to the use of biometric data for various payment methods.

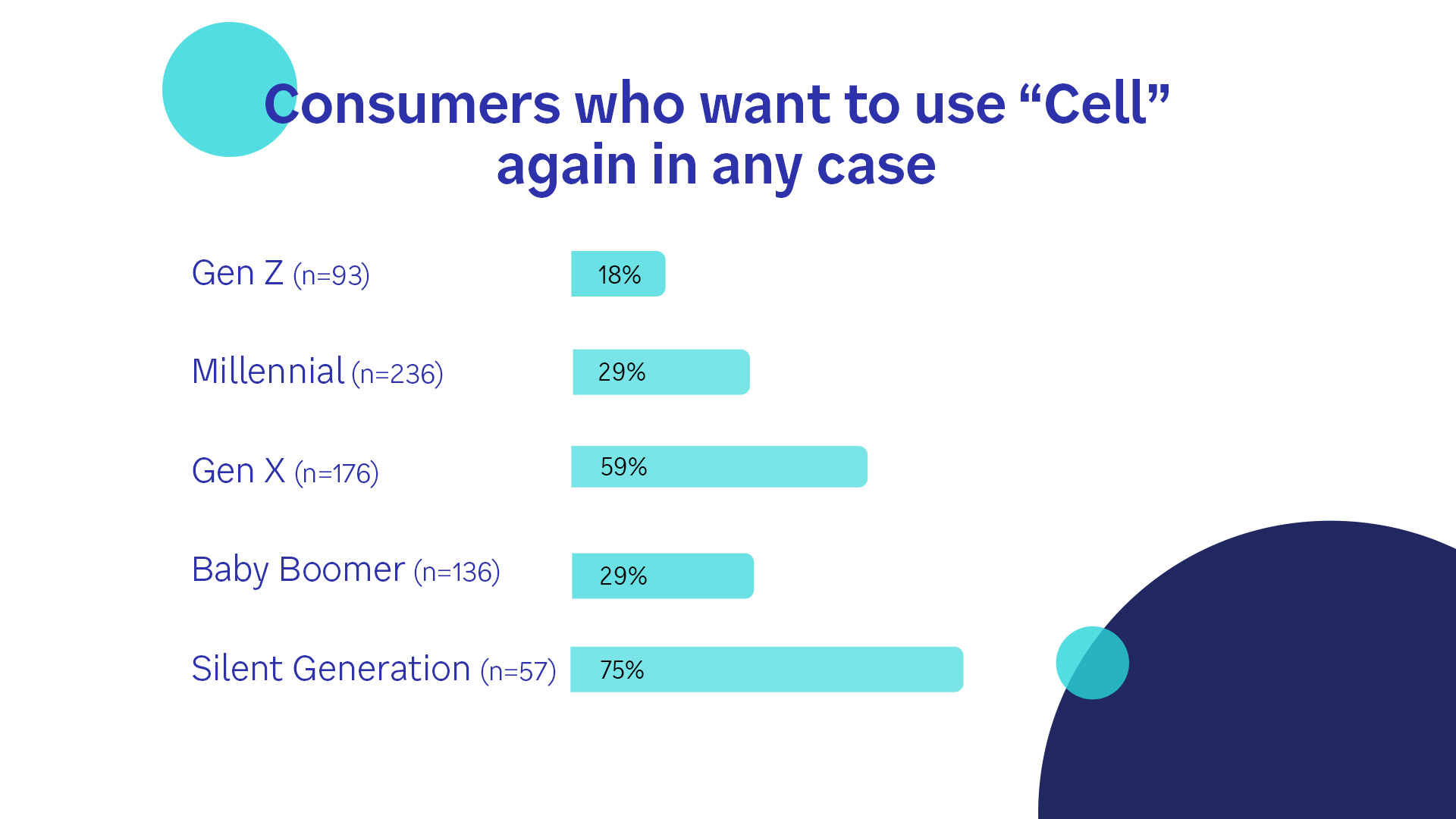

5. There is Great Interest in Account-To-Account Options

Peer-to-Peer (P2P) and other account-to-account applications like allow consumers to quickly send and receive money to and from each other via their computers or mobile devices. Many of the respondents who use Zelle use it to send money to family and friends. The survey found that Gen Z and Millennials are more likely to use Zelle for money transfers than Gen X, Baby Boomers or the Silent Generation. However, the technology appeals most to Gen X, who are most likely to use Zelle again after using it at least once. ²

The number of Silent Generation respondents who intend to use Zelle again was considerable, but not sufficient to make a general statement.Q: Do you intend to use Zelle again? Base: All respondents (n=700). Source: Survey commissioned by Discover Global Network, 2024.

Prospects

Consumers' expectations of payment transactions are subject to constant change. This is reflected in the different patterns that our survey revealed in the behaviors and preferences of different generations and regions. The technology that is driving innovation in payments is evolving and so is the way people want to pay.

The information contained herein has been sponsored by Discover® Global Network. It is for informational purposes only and is not intended as a substitute for professional advice. Here you can read the original article.

1. (December 2023). How SoftPOS Is Poised to Revolutionize Payments.PYMNTS. Retrieved February 26, 2023.

2. TSG (The Strawhecker Group). (2024). Payment Trends Shaping North America & Europe. Commissioned by Discover Global Network. Retrieved February 26, 2024.

3. (March 30, 2023) Why buy now, pay later is a trend to watch.Global Payments. Retrieved February 26, 2024.

4. Smith, Kevin. (November 24, 2023) Amazon's 'Just Walk Out' technology makes its way to Six Flags, other retailers.Los Angeles Daily News. Retrieved February 26, 2024.

5. Perez, Sarah. (July 20, 2023 ) Amazon's palm-scanning payment technology is coming to all 500+ Whole Foods.TechCrunch.Retrieved February 26, 2024.