Data on payment behavior in Germany shows that consumers are becoming increasingly digital. This potentially gives an advantage to those retailers who can successfully adapt to the resulting payment trends.

In the past, the German payment landscape was often described as conservative and cash-oriented. It was seen as an environment in which the greatest trust was placed in physical means of payment - "physical-first", so to speak. However, Germany has made rapid progress in recent years - and is increasingly able to compete with the most digitally developed economies in Europe.

The pandemic has accelerated changes in consumer behavior and merchant offerings, making Germany the country with the fastest growing e-commerce industry in Europe. According to the European Central Bank, the share of contactless payments has also risen from 3% to 69% between 2017 and 2022. This suggests that consumers in Germany have really embraced modern payment methods for both in-store and online shopping.

The rapid change demonstrates that payment transactions are not only relevant at the point of sale. They can also serve to collect data to optimize revenue, provide consumers with more convenience, and foster customer loyalty.

However, in the current economic climate characterized by slower growth and high inflation, merchants must adapt their payment systems to the current trends.

Scandinavia, as one of the most digitally advanced regions in Europe, has taken a leading role, especially concerning cashless payments. This trend is increasingly relevant in Germany as well, as customers seek more options when shopping.

As a result of this trend, German retailers are facing an increasingly complex environment. In this article, we take a close look at current data and illuminate the payment trends that retailers can benefit from in the near future.

Instore: Card Payments Have Taken the Lead

The physical retail sector in Germany comprises approximately 300,000 companies. However, the number of instore retailers has significantly declined in recent years, and the pandemic has dealt another blow to the industry. Consequently, businesses must be mindful of how they engage with their customers in-store.

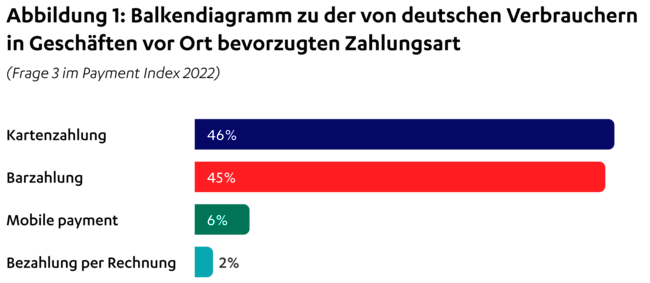

As in all other countries around the world, cash was king in Germany for many years - but now the tide seems to be turning. According to a recent consumer survey on payment methods in Germany conducted in 2022 by Sifo/Kantar on behalf of Concardis | Nexi, the preferred payment method of German consumers in brick-and-mortar retail is card payments, accounting for 46 percent. Cash comes in a close second at 45 percent. However, this marks a significant milestone already (see Figure 1).

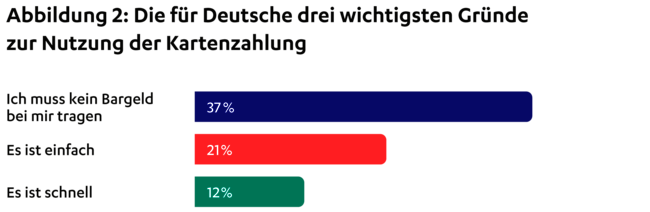

Consumers are changing their habits and are no longer handing over coins and banknotes across the counter. Instead, they are tapping and swiping their cards more frequently at or over a card reader. When it comes to card payments, they particularly appreciate how easy and fast it is. Many are now even foregoing carrying cash altogether (see Figure 2).

The increase in card payments is a trend observed in most European countries. In Scandinavia, for example, over 80 percent of consumers now prefer card payments in-store. Only a few percent still pay in cash.

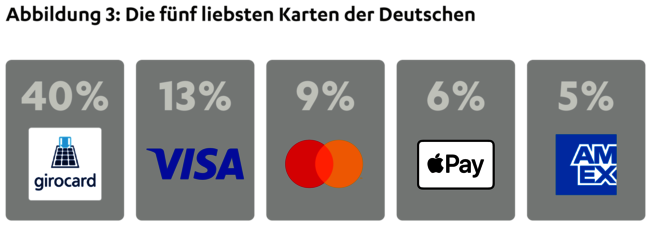

The preferred cards in Germany are the Girocard, as well as Visa and Mastercard (see Figure 3). The use of card payments varies significantly by gender and age. 39 percent of men in the 18 to 29 age group prefer to pay with a card in stores, while for young women, it's 57 percent. As age increases, the ratio reverses: among consumers over 65 years old, slightly more than half of men prefer card payments, while for women, it's only 41 percent.

Taking a look at other regions where cards have effortlessly replaced cash as the preferred payment method in stores, a clear trend emerges: card payments will continue to gain popularity in Germany, as will mobile payments, although they mostly still involve card-based transactions. This provides various opportunities for retailers to optimize revenue. However, it should be evident for merchants to support all relevant card and mobile payment methods in the future.

E-Commerce on the Rise

E-commerce in Germany is thriving. The pandemic has spurred innovations that have unfolded at an unprecedented pace. Retailers who embraced e-commerce as a distribution channel were richly rewarded. According to the European E-Commerce Report 2021 by Nexi, e-commerce in Europe saw the strongest growth in Germany (with an increase of 18 percent), followed by Denmark (11 percent) and Sweden (10 percent). The growth has since slowed down as many customers have returned to in-store shopping with the lifting of pandemic-related restrictions. However, consumers will not completely abandon their changed habits. It is now up to retailers to strive to maintain the momentum that has been created..

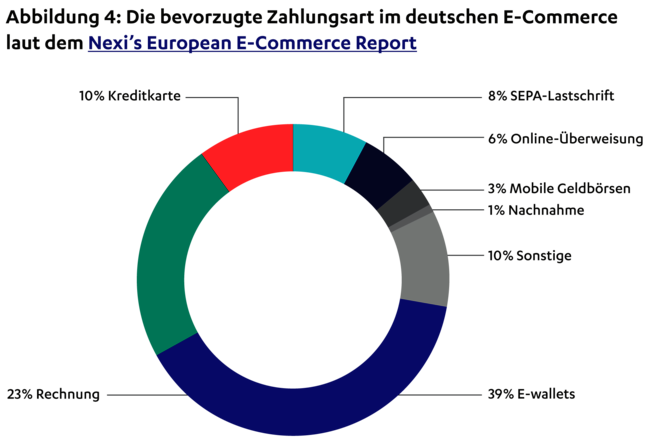

According to the report cited above, E-wallets are by far the most popular payment method in online commerce in Germany. 39 percent of all Germans prefer them when shopping online via computer or smartphone, as the method is both easy and secure. Payment by invoice is preferred by 23 percent of Germans, while card payments currently stand at only 10 percent (see Figure 4).

Germany has experienced extreme growth in online commerce, primarily fueled by the pandemic but later also by a strong desire for a convenient and secure shopping experience. To anticipate future trends, it is worthwhile to look to Scandinavia. For example, it is important to offer customers options for convenient and transparent delivery as well as various methods for easy and quick payment to not only meet but exceed their expectations.

Next Stop: Omnichannel?

The difference between shopping in-store and online is becoming increasingly smaller: consumers expect to find the same goods offline as they do online in the future. They expect the same range of products, payment methods, and seamless interaction between the online store and the physical store. Click & Collect, for example, is a method that allows customers to pick up online orders at the local store.

However, consumers in Germany have not yet become accustomed to these options. According to our consumer survey from 2022, 66 percent of consumers have never used Click & Collect.

Another shopping method is Scan & Pay. Here, the customer takes all the shopping steps into their own hands in the store: they take the products off the shelf, scan them with an app, and pay at the self-checkout or with their smartphone. However, our survey has shown that 70 percent of German consumers have never used Scan & Pay.

These two examples are services that are obvious to integrate into omnichannel platforms, and they are likely to be used more in Germany in the future than in the past. In the Scandinavian countries, these technologies are often at the top of the priority list and German retailers should also consider them. In Norway, for example, more than 60 percent of customers use these convenient shopping options, according to our survey.

According to our survey, German consumers are just as happy to shop online as in-store. They greatly appreciate being able to see and touch the product in-store, but have also become accustomed to the seamless online shopping experience. This behavioral pattern is a strong argument for omnichannel solutions that combine the online and offline shopping experience.

The omnichannel approach also fits well with the tokenization of credit cards, which enables more convenient loyalty solutions as well as the collection of important consumer data. For example, loyalty points can be integrated with the consumer's payment card and customer trends and habits can be analyzed.

Our survey, however, revealed that 62 percent of participants in loyalty programs in Germany still receive physical customer cards. Meanwhile, 67 percent of consumers find it useful if their loyalty points are automatically captured on their payment card. This interesting discrepancy between the services offered by retailers and the expectations of customers can be overcome with new, modern solutions and potentially with an omnichannel platform that enables payment card tokenization.

The current opportunity for merchants to start tokenizing payment cards is very good. This would enable more advanced digital services and offer greater added value to consumers. In addition to these benefits, tokenization can also be used to integrate shopping vouchers, loyalty points and digital receipts with the customer's preferred digital payment method.

In times of high inflation, merchants need to be aware that details matter and that even small adjustments in the payment process can make a big difference.

Three final tips for retails

Be prepared for permanent changes in consumer behavior

Consumers generally change their behavior and habits very slowly. Experience in the Scandinavian countries has shown this. But in Germany, these changes have taken place faster than ever before in recent years. However, these changes do not happen overnight. Merchants have enough time to jump on board the trend that is currently profoundly changing the payment landscape in Germany. It is crucial for them to keep a close eye on payment trends and adapt to them accordingly.

Rely on convenience to increase your sales

Convenience is key. Therefore, consider which payment methods are most convenient for your customers and which ones your company can benefit from the most. Cash will continue to play a role in Germany's in-store transactions for many years to come, but those who do not accept cards and do not enable contactless payments are likely to miss out on revenue opportunities. Consider implementing omnichannel solutions such as Click & Collect or Scan & Pay. As in Scandinavia, they hold great potential in Germany as well. Overall, the clear guideline is: the easier the experience, including payment, is made for the consumer, the more revenue will be generated.

Merging Online and Offline Payments

If retailers offer their products and services on multiple channels, an omnichannel strategy is a must-have to enable upselling and cross-selling. Different payment methods and tokenization, which offer numerous advantages across all channels, are the way to go. This benefits both consumers and retailers by making the process more convenient and providing better purchasing data that can help retailers offer the right products to individual customers. The ability to seamlessly switch between online and offline purchases is an undeniable convenience that consumers will appreciate. However, this requires full commitment and complex but necessary system upgrades.