Given the increasing popularity of "Buy Now, Pay Later" (BNPL), merchants must carefully consider the role this payment option should play in their payment strategy. To leverage BNPL optimally, the entire purchasing process should be aligned with the advantages of this payment method.

While "Buy Now, Pay Later" (BNPL) is not an entirely new concept, it is currently receiving renewed attention and is among the most discussed topics in global retail.

An increasing number of German retailers are also considering whether to offer BNPL as a payment option to their customers. Internal Nets data and local market research studies indicate a clear trend in favor of this. A survey conducted among the top 500 online retailers in Germany (raw data from the EHI Study Online Payment Top 500, 2020) reveals that shops offering BNPL have grown 46% stronger compared to those without invoice purchasing options.

When discussing BNPL, it's important to note that the term typically encompasses several payment methods. This includes invoicing, where the consumer usually has 30 days after receiving the goods to settle the invoice; however, BNPL also includes installment payments. In the UK and the USA, installment payments are the predominant form of BNPL; whereas in the DACH region, invoicing predominates.

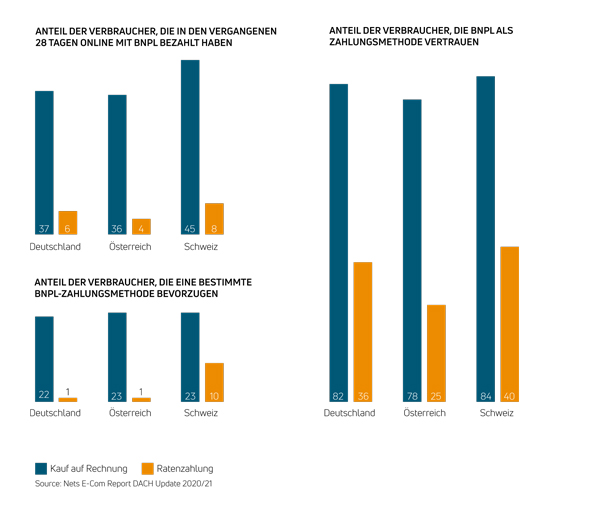

For historical and cultural reasons, BNPL is already widely adopted in the DACH region. Data from the Nets E-Com Report DACH Update 2020/21 reveals that 37% of Germans opt for invoicing and 6% choose installment payments for online purchases. One reason for this is undoubtedly the high level of trust enjoyed by this payment method in the DACH region, as indicated by 82% of German, 78% of Austrian, and 84% of Swiss consumers (see Figure 1).

Figure 1: BNPL Consumer Preferences in the DACH Region

The participants of the Nets E-Com Report DACH Update 2020/21 were surveyed about their preferred payment options.

Why is BNPL so popular in Germany?

There are several reasons why most consumers in Germany prefer BNPL as a payment method. Many consumers indicate that they can better manage their finances this way and appreciate the option to pay for the ordered goods only when they are truly satisfied with them. In the Nets E-Com Report DACH Update 2020/21, respondents from Germany stated a preference for invoicing because it is secure (58%), easy (34%), and offers the possibility to defer payment (32%).

In Germany, clothing and footwear are particularly commonly purchased on invoice, as this allows customers to try on the ordered items before making payment. Unwanted items can be returned, and only the pieces one wishes to keep are paid for, without the need to handle refunds for the remaining amount. This reduces risk for the consumer on one hand, while also affording them full control over the payment process, fostering a sense of trust and autonomy.von Vertrauen und Selbstbestimmtheit fördert.

For larger purchases such as furniture or expensive electrical and household appliances, many customers opt for installment payments. This allows them to acquire and use the desired products without the need to save up or take out a loan beforehand.

What merchants should consider in their own BNPL strategy

Offering customers the option of purchasing on invoice or through installment payments provides a clear competitive advantage. However, to fully capitalize on the growth potential and benefits of BNPL, merchants must consider several aspects.

1. Aligning the purchase process with BNPL

Given that BNPL is particularly appealing to consumers who would otherwise refrain from purchasing due to uncertainty or high prices, merchants should actively promote the option of invoicing or installment payments. This should be incorporated into their advertising and point-of-sale materials to attract customers.

BNPL always requires identity and credit checks. After all, neither merchants nor consumers have an interest in purchases that exceed the financial capabilities of the customers. The corresponding checks should ideally proceed seamlessly to keep up with faster and simpler payment methods like cash or credit card payments.

Another advantage for consumers is that they can complete the purchase and payment with BNPL using the data that the merchant already requires for order processing, such as the email address, shipping and billing address, or telephone number. The only additional information required is the birthdate. This makes online shopping very convenient, as the consumer does not need to remember login details (e.g., for PayPal), PAN or CVV (for card payments), IBAN (for PIS services and direct debit), etc.

Furthermore, many modern BNPL payment solutions utilize AI-based credit checks, where data from various sources such as Schufa are queried and matched with behavior-related customer data to prevent fraud. As a result, the checkout process can be completed with minimal risk almost with a single click.

2. BNPL as a Means of Customer Retention

Through this exchange of information and customer data, BNPL also offers the opportunity to build closer customer relationships. Once the credit check is positive, the data can be stored to increase the likelihood of repeat purchases. It is crucial for merchants to gain the trust of the consumer. They can contribute to this by, for example, transparently presenting all costs and conditions, providing communication channels for customer inquiries, and refraining from requesting irrelevant personal data.

Communication and customer service after the purchase are also important. Payment reminders should be formulated cautiously to ensure a positive interaction with tardy customers. Customer service representatives must be trained to assist customers with typical questions regarding the BNPL process. A benchmark study indicates that, on average, 40% of all customer service inquiries relate to the payment process (Source: "Customer Service in the Digital Age," Pidas). Therefore, a high level of competence among customer service representatives is essential.

This is especially true when offering BNPL through an external payment service provider. In this case, the merchant essentially sells the invoice to the BNPL service provider, who often takes over customer communication thereafter. It is therefore crucial for the merchant to choose a payment service provider that shares the same values and understanding of customer service, as poor communication is likely to be attributed to the merchant and ultimately harm their reputation.

3. Selecting the appropriate BNPL solution

The choice of the right solution and its optimal integration into existing payment systems play a crucial role when merchants aim to introduce BNPL as a payment option. Adapting existing systems to accommodate BNPL, conducting credit checks, managing fraud risks, and ensuring compliance with all laws and regulations are highly complex matters typically manageable only by large enterprises. For most merchants, utilizing a third-party solution is therefore the most realistic option.

An external payment service provider typically charges a fee for conducting credit checks and handling payment processing for each transaction. For the merchant, this provides the additional benefit of receiving immediate payment for the purchase. Consequently, the service provider assumes the entire risk of default should the customer prove unable or unwilling to pay.

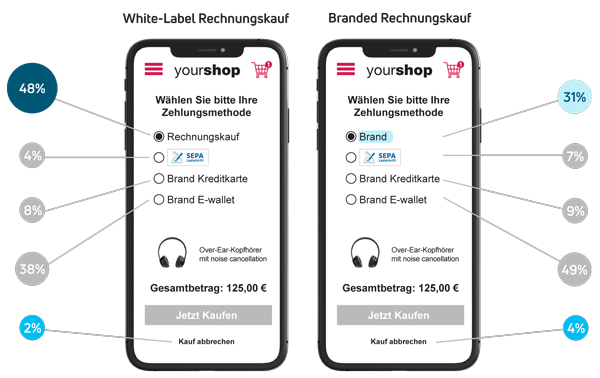

Some third-party providers offer their BNPL solutions under their own brand name and as a white-label version, which can be easily customized to match the design of the online store. Bilendi, on behalf of the BNPL provider RatePay, found that the conversion rate is higher with a white-label solution. 48% of customers opted for the white-label invoicing option, whereas only 31% chose invoicing when offered under the brand name of a third-party provider (see Figure 2).

Figure 2: White-Label vs. Branded BNPL

A study indicates that white-label solutions for invoicing increase the conversion rate and reduce purchase abandonment. 48% of respondents preferred invoicing with a white-label version, whereas only 31% opted for invoicing when offered under the brand name of a third-party provider (Branded Invoicing).

How merchants can increase revenue with BNPL

Especially for German merchants, it makes sense to offer BNPL as one of several payment options both online and in brick-and-mortar stores. In Germany, invoice purchasing is so popular among consumers that merchants otherwise risk losing a significant portion of potential customers to competitors. Therefore, merchants should seize the opportunity to attract new customers and retain them in the long term by offering a payment method that is perceived as secure, easy, and flexible.

For further inquiries on this topic or any other concerns, we are also available to assist you over the phone. Feel free to contact us. We look forward to hearing from you!